This is a continuation of my Once Upon a Bookshop: The Beginning - Part Two.

Dream For Lease

Since my first visit to Niwot, I was hooked on the small-town feel. I returned often for food and coffee and to take part in the charming town events. My daughter’s Girl Scout troop walked in the Christmas parade along with local businesses, fire trucks, and, of course, Santa and Mrs. Clause riding in a horse-drawn carriage. The town held summer concerts in the large park, art walks with wine along the historic strip, and nights of dancing under the stars in the transformed parking lot of the town’s small shopping center. Going to Niwot for a town event was like visiting a Hallmark movie. I loved what they were doing, and I wanted so badly to be a part of it.

Near the end of 2018, only a year after I’d fallen in love with the Tribune building, I noticed a For Lease sign hanging where the previous tenant’s business sign used to be, and I immediately contacted the realtor. Because I loved the town just as much as the building, I had been searching for other spaces in the area that might be a good fit. Even though a couple of spaces were available along the historic strip, none had the same playful character and magical pull of the Tribune building. They did, however, have a much lower price per square foot, but not even that was enough to entice me away from the space I’d fallen in love with. It was, however, enough to make me question it.

Request for Info: 198 2nd Ave, Suit A, Niwot, CO 80544

Hello . . . ,

I am interested in this space for the location of my children’s book store [sic], but I am also looking at other options in the same location and I am confused as to why the price per square foot for this property is more than double the amount of other leasable commercial space located on the same street with the same exposure. Could you please send me the details of the cost comparison for this space that would justify such a disparity in price?

Thank you for your help. I look forward to hearing from you.

The realtor responded almost immediately. The price per square foot was higher due to the building’s corner lot location, its historical significance, and its incredible curb appeal (all of which, I’ll admit, were part of the reason I’d fallen in love with it), and the smaller square footage was apparently more desirable for small and specialty businesses (obviously, I couldn’t argue that point being that I wanted to open my small, specialty business in that space). But it didn’t matter anyway because they already had an offer.

My heart sank. I was too late. I’d missed my chance. I wanted to scream. To cry. To curse the universe for not somehow leading me there the moment the space went up for lease. But even though they had an offer, the realtor encouraged my interest (most likely to have a backup in case the original offer fell through). So, thinking anything was possible, I continued with my well-researched questions about the lease details. I figured that, if nothing else, it would be good practice for when I found a space I wanted to lease.

Re: Request for Info: 198 2nd Ave, Suit A, Niwot, CO 80544

Thank you for your quick response, . . . I have some additional questions below:

Does the $2000/mo include NNN? If not, what is the NNN for this space? Does that include water and sewer? Are any other utilities or services included? Who is responsible for maintenance and repair? Is there a build-out allowance offered? Abated rent? What is the requirement for prepaid rent and security deposit? Do you have a standard lease term? Are the lease rates graduated?

Sorry for the barrage of questions. I appreciate your help.

*NNN stands for Triple Net, which is a type of lease where, in addition to the base rent, the tenant pays a specific amount per square foot to help cover the insurance, maintenance, and taxes on the property; a build-out allowance is an agreed-upon amount that the landlord will pay or reimburse the tenant for renovation expenses; abated rent is reduced or suspended rental payments for a specific amount of time usually to allow the business to perform the necessary preparations and renovations before opening; and graduated lease rates increase the base rent by a specific amount every year (one of the main reasons small businesses get priced out of their spaces over time).

The realtor responded that the $2,000 did include triple net. The base rent was $26.60 per square foot, with the NNN breakout $8.70/SF. While the lease included water and sewer, the other utilities were not included. The landlord would be responsible for maintenance and repair of the building systems and common areas, but the tenant would be responsible for anything inside the walls. The lease rates were graduated at 4%, and they were open to negotiating a build-out allowance and abated rent, but that depended on the lease term and financials.

The rate was higher than I’d estimated, so I had to recalculate my financial projections. But by the time I reached back out, the space was leased, which was probably for the best. I still wasn’t keen on taking out a loan and had no other way to fund the venture. So, again, I put my plans aside and waited for another sign.

Luck, Fate, and Finance Walk into a Bookshop..

In early 2021, my husband and I sold our condo—a real estate investment property we’d bought a couple of years earlier with the agreement that when that property sold, I could use the proceeds to open my shop (while my paychecks were never a big part of my family’s financial security, my ability to find and invest in properties always proved profitable). I finally had the money I needed to pursue my dream. The only problem was I still didn’t have the space.

I found a much less appealing space in a high-end outdoor mall area not far from my house. It would have been a good location, with lots of foot traffic. There was a little play area right outside the shop doors where they held concerts and other events. This space had only two problems: 1. the rent was astronomical, and 2. I couldn’t picture my bookstore there. In my head, I still saw it in that cozy little spot in the tiny train town I’d grown to love.

As luck, or maybe fate, would have it, a few months after we sold the condo, the Tribune building was once again for lease. I contacted the realtor, who, unsurprisingly, didn’t seem to remember me, but he loved the idea of having a children’s bookstore in the space—apparently, the last business they leased to used it as an extension of their office, which had ruffled feathers in the business community, all of whom wanted to add more retail to the little historic street in an attempt to boost foot traffic.

The lease, however, was even more expensive than the last time I inquired (see the bit about graduated lease payments). I needed to redo my financials again. This time, though, I didn’t delay. I ran the numbers that very same day and scheduled an appointment to see the inside.

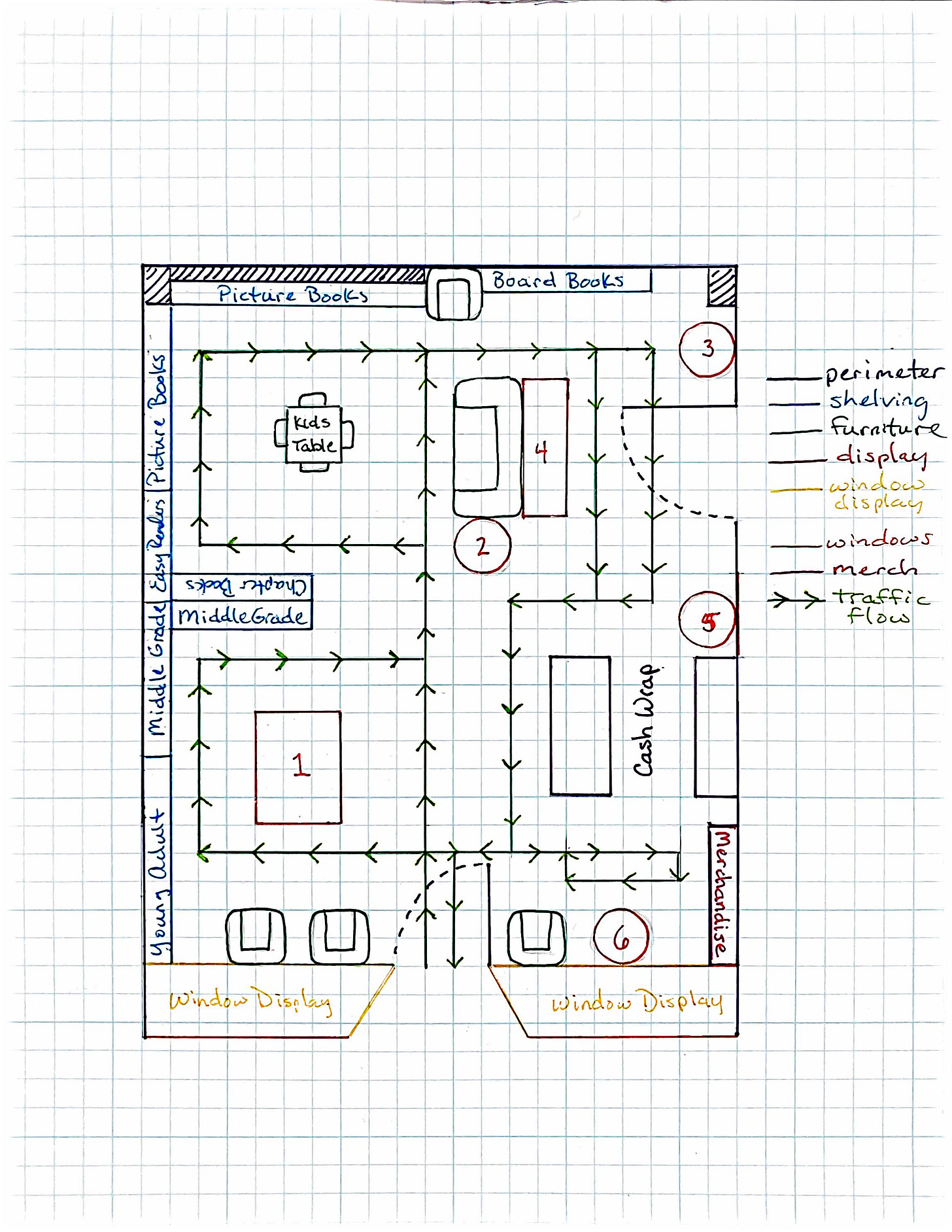

The moment I stepped onto the creaky, warped wood floors, I felt like the space was hugging me, welcoming me home. As I walked through the empty space, I pictured the bookshop as if it were already there, just waiting to be brought to life. There was the cash wrap. There was the comfy couch and storytime chair. There were the display tables. There and there and there were the large, wooden bookshelves bursting with beautiful books, and, of course, the rolling ladder. And there I was, standing in the middle of The Wandering Jellyfish.

When I arrived home, I sketched out a floor plan of how I imagined the space, making sure to incorporate a customer flow chart with ADA (Americans with Disabilities Act) accessibility. Then, I contacted a contractor to find out how much the renovations would cost. But I couldn’t get the contractor in to see the space right away, and I needed to make my offer fast, so I sent over my Letter of Intent asking for a 3k allowance for improvements, 3 months abated rent to get the space ready, and a few other concessions. Then, I crossed my fingers and begged the universe to help.